Between 2 to 2.5 million digital creators are influencing over Rs. 29,60,300 crore (US$ 350 billion) in annual consumer spending, a number expected to surpass Rs. 84,58,000 crore (US$ 1 trillion) by CY30.

In the Union budget of FY26 the Ministry of Information and broadcasting received Rs. 4,358 crore (US$ 515.5 million).

The Indian entertainment sector could unlock an estimated Rs. 50,724 crore (US$ 6 billion) in unrealised value by FY30, according to a recent industry report. This growth potential is attributed to international collaboration, technology adoption, and strategic changes in content creation.

Indian advertising revenues is projected to grow at a CAGR of 9.4% to reach Rs. 1,58,000 crore (US$ 19.2 billion) in FY28, which is 1.4x the global average of 6.7%.

The online gaming and sports sector in India is growing at a CAGR of 19.2% and is projected to reach Rs. 39,583 crore (US$ 4.8 billion) by FY28. The total music (live, recorded and digital) revenue grew from Rs. 2,416 crore (US$ 293 million) in FY19 to Rs. 6,686 crore (US$ 811 million) in FY23. It is expected to cross Rs. 10,899 crore (US$ 1.3 billion) by FY28, growing at a CAGR of 10.3%. OTT platform revenues in India are projected to grow at a remarkable CAGR of 14.9%, the highest among the top 15 countries, to reach Rs. 35,061 crore (US$ 4.25 billion) by FY28.

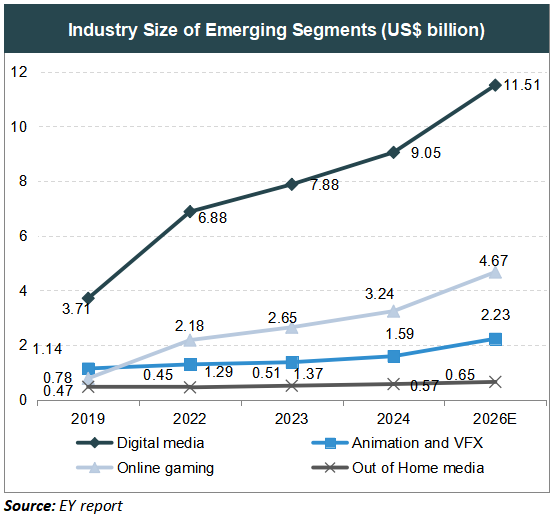

India's Animation and VFX sector is projected to grow from US$ 1.3 billion in 2023 to US$ 2.2 billion by 2026, increasing its share of the media and entertainment (M&E) industry from 5% to 6%, according to a CII GT report.

Media companies are projected to achieve an 8% revenue growth, reaching US$ 7.14 billion (Rs. 60,000 crore) by FY27, driven by increasing contributions from the digital segment, according to a Crisil analysis of 20 companies that account for 55% of the media industry's revenue.

India's Entertainment and Media (E&M) industry is set to outpace global growth, with a compound annual growth rate (CAGR) of 8.3%, projected to reach US$ 43.03 billion (Rs. 3,65,000 crore) by FY28.

In the year 2023, the revenue from subscriptions for over-the-top video platforms across India amounted to approximately US$ 0.88 billion. This was expected to peak at over US$ 1.2 billion by 2026.

According to Media Partners Asia's Asia Pacific Video & Broadband Industry 2024 report, India's video market, encompassing both TV and digital, is projected to grow from US$ 13 billion in 2023 to US$ 17 billion by 2028.

In 2024, the projected revenue in the Digital Media market in India is expected to reach US$ 10.07 billion. It is expected to contribute 38% to the overall advertising industry in India, on par with television.

The OTT segment is likely to grow at a remarkable CAGR of 14.1% to reach Rs. 21,032 crore (US$ 2.55 billion) in 2026. Subscription services, which accounted for 90.5% of revenue in 2021, are projected to account for 95% of revenue by 2026.

The AVGC sector is estimated to grow at ~9% to reach ~Rs. 3 lakh crore (US$ 43.93 billion) by 2024, stated Union Minister of Commerce & Industry, Consumer Affairs & Food & Public Distribution and Textiles, Mr. Piyush Goyal.

Indian Over-The-Top (OTT) platforms have demonstrated significant growth in the global market, witnessing a 194% increase in revenue from international viewers over the last two years.

India’s Direct-To-Home (DTH) Services market is expected to expand to US$ 7.59 billion in 2029 from US$ 6.48 billion in 2023.

As per GroupM’s TYNY report 2023, India was ranked 8th by global ad spend and will continue as the fastest growing market among the top 10 ad markets in 2023.

Key growth drivers included rising demand for content among users and affordable subscription packages.

India’s media and entertainment industry is the fifth largest globally, valued at about Rs. 2,50,000 crore (US$ 30 billion) in FY24 and is projected to grow at a CAGR of around 7% to Rs. 3,10,000 crore (US$ 36 billion) by FY27.

The Indian mobile gaming market is poised to reach US$ 7 billion, in value, by 2025. The online gaming segment grew 22% to become the fourth largest segment of the Indian M&E sector in 2023, displacing filmed entertainment.

The music industry is expected to reach US$ 445 million by 2026 from US$ 180 million in 2019. According to a study conducted by Kantar and VTION, an audience measurement and analytics company, Gaana, the streaming service owned by Times Internet Ltd., had 30% market share, followed by JioSaavn (24%), Wynk Music (15%), Spotify (15%), Google Play Music (10%), and others (6%) in 2020.

By 2025, the number of connected smart televisions are expected to reach ~40-50 million. 30% of the content viewed on these screens will be gaming, social media, short video, and content items produced exclusively for this audience by television, print and radio brands. By 2025, ~600-650 million Indians, will consume short-form videos, with active users spending up to 55 to 60 minutes per day.